There are many issues that arise when it comes to senior care – one of the senior care tips to keep in mind regards estate planning. You’ve likely been repeatedly advised to ensure for your own estate planning, but as you take on caring for your elderly loved ones, you may also need to become familiar with their estate plan.

There are many issues that arise when it comes to senior care – one of the senior care tips to keep in mind regards estate planning. You’ve likely been repeatedly advised to ensure for your own estate planning, but as you take on caring for your elderly loved ones, you may also need to become familiar with their estate plan.

If your elderly loved one has not put his or her affairs in order, it should be done immediately, so you can be sure about his or her wishes before he or she becomes too incapacitated to communicate those wishes to you. Wills need to specify not only wishes for “handing on” precious keepsakes and possessions but also written directives as to how your elderly loved one wishes his or her remains disposed of, funeral and burial plans, and so on. Advance directives include the senior’s living will, which states his or her wishes in case he or she is near death and wants no life-saving, artificial measures taken to restore or preserve life, and medical power of attorney, also known as a health care proxy, enables the senior to designate a loved one as the decision maker for medical concerns in case he or she is unable to do so. A power of attorney allows the senior to give another the power to act on his or her behalf if he or she is in unable.

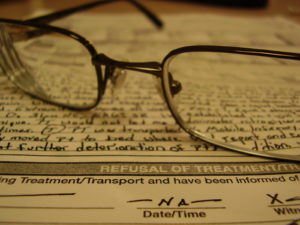

Be sure your senior caregiver is aware of where these important papers are kept (or has copies of them) and can access them in order to provide medical professionals with these critically important instructions during medical emergencies . For instance, emergency medical professionals in an ambulance or at a hospital emergency room will request copies of a patient’s do not resuscitate order (DNR) or medical power of attorney.

Advance directive

This is a legal document that specifies that you do not want to be kept alive on artificial life support and can direct other aspects of health care if the elder is unable to speak for him- or herself. As with most legal documents, this needs to be as specific as possible, providing instructions regarding respirators, feeding tubes, and pain medication, among other things. Advance directives usually include a DNR, a living will, and a durable power of attorney.

- Do Not Resuscitate: known as a DNR, is a written order directing health care professionals to not resuscitate a patient in case of cardiac or respiratory arrest. DNRs are generally given when resuscitation would only delay the inevitable and leave the patient severely and permanently incapacitated.

- Durable power of attorney: enables a senior to authorize a specific person to make financial or health care decisions for him or her. Durable powers of attorney are most often effective when a doctor certifies that the patient is incapacitated; however, a durable power of attorney could begin upon signing the document. It will depend on the document’s wording as to when the powers begin.

- Living will: a document that states in detail acceptable medical procedures and life-sustaining measures. It does not name someone to act on a senior’s behalf like a health care proxy, or medical or durable power of attorney. Living wills should be made available upon admission to any health care facility and to doctors, as well as kept on hand in the elder’s home. (A living will is not necessarily legally binding—state laws vary widely. Some hospitals and physicians may refuse to honor a living will in an attempt to keep the senior patient alive.)

Legal guardianship

A guardian is appointed by the court to have custody of another. Legal guardians may be appointed on a temporary basis (for a fixed period, i.e., one year) and for a senior’s medical consent. In short, a guardian may make medical decisions for the senior and work directly with medical professionals.

Living trust

According to AARP, a revocable living trust is a written agreement designating someone to be responsible for managing the senior’s property. It is called a living trust because it is established while the senior is alive. It is “revocable” because, as long as you are mentally competent, the senior can change or dissolve the trust at any time at his or her own discretion for any reason. Typically, a living trust becomes irrevocable (cannot be changed) when the person dies. As a trustee, you (as the senior’s designated relative or friend) can manage the assets, including selling or investing them. You may also name your spouse as your co-trustee. If every asset is transferred into the living trust while the senior is alive, a living trust may substitute for a will. A pour-over will can be written to ensure that at the time of death any property not in the living trust is poured over into the trust.

Will

This is a legal document in which the senior declares who will manage his or her estate after he or she dies. The estate can consist of anything he or she owns—it may be as big as the senior’s home and as small as the deceased’s grandmother’s cameo pin or even a photograph.

There are professionals, namely attorneys and financial advisors, who specialize in elder law and estate planning. Since laws vary by state and are often subject to change, it is advisable to contact one. New York State’s legal services department may offer help at its Division of Elder Law, or you may access AARP’s prescreened list of attorneys.

For more information about how we help families with senior care issues, contact us at (518) 348-0400.