Offering employee benefits is an important consideration for all household employers. Families can get tax savings while providing more than a paycheck – they can attract and retain the best nannies by offering them tangible benefits such as health insurance, savings accounts, and retirement plans.

Health Benefit Options

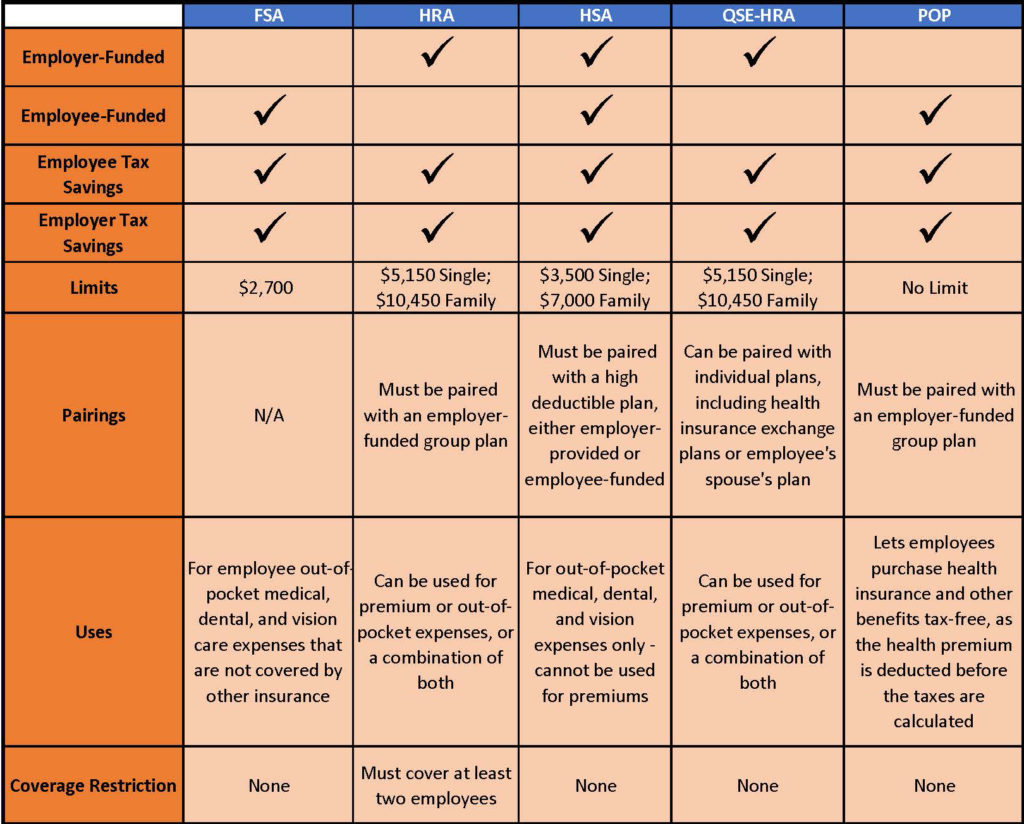

• Flexible Spending Accounts (FSAs)

• Health Savings Accounts (HSAs) and Health Reimbursement Accounts (HRAs)

• Qualified Small Employer (QSE) HRAs

• Premium Only Plan (POP)

Other Benefits

Retirement Plans: Offering a 401(k) or IRA will not only give families a recruiting advantage over other families and a retention tool for their employee, but it will also help their nanny build an excellent source of retirement income and experience the benefits of tax-deferred growth.

Concierge Medicine: Nannies can get answers to medical questions, schedule a consult, and share pictures or videos with a doctor. Perfect for diagnosing and treating colds, allergies, rashes, injuries, and more, so nannies don’t miss work going to the doctor or calling in sick.

Transit Parking FSA: For workers who need assistance paying for transit and parking, employers and employees can set aside up to $520 a month in a tax-free Transit and Parking FSA account.

Interested in offering any of these to your nanny? Call us at (518) 348-0400 and we can help get things started.