Did you know that in New York, children can start working at the age of 14? With the school holiday break coming up, if you have a teenager who'd like to earn some extra money (or in the summertime as well), let's take a look at New York's child labor laws. Work...

Blog Category:

Employing a Nanny

Blog Categories

What Nannies Need to Know About New York Paid Family Leave

We posted an article about how the upcoming New York Paid Family Leave (PFL) law will affect household employers, but nannies and other household employees may have many questions about how they can use this new benefit. ShelterPoint has put together this handy list...

Hiring Through an Agency is the Right Choice

Online job boards have become a more popular way for families to hire a nanny or other domestic worker in recent years, and while both agencies like A New England Nanny and job websites each have benefits, there are some key differences that demonstrate why hiring...

Backup Staffing for Schools and Daycare Centers

What do daycare centers do when they have unexpected call-outs from their staff, or their ratios are not up to where they should be? What if they’re in the process of hiring for a new position and need fill-in help? Back-up care from A New England Nanny might be...

Hiring Senior Care: Options and Questions

For families that wish to hire a caregiver for their senior loved one, there are many options available. It's important to understand these options and to know what questions to ask. There are typically three options for obtaining in-home senior care. 1. Home Health...

Proposed Regulations to Help Prevent Identity Theft

Fresh off the recent Equifax breach , the IRS has proposed regulations that may help individuals prevent identity theft when it comes to their W-2s. The proposal would allow truncated Social Security numbers (SSNs) on Form W-2 in the form of Taxpayer Identification...

Nanny Tax Compliance Infographic

Mistakes or misinterpretations of nanny tax compliance laws can mean IRS audits, thousands of dollars in fines and penalties or an employee lawsuit. Our friends at GTM Payroll Services have created this handy infographic that highlights what you need to do to maintain...

What You Can Do About the Equifax Breach

Nearly half of the country’s population was affected by the recent breach of Equifax, the consumer credit reporting agency that collects driver’s license numbers, Social Security numbers (SSN), and credit card numbers. Hackers gained access to the information of 143...

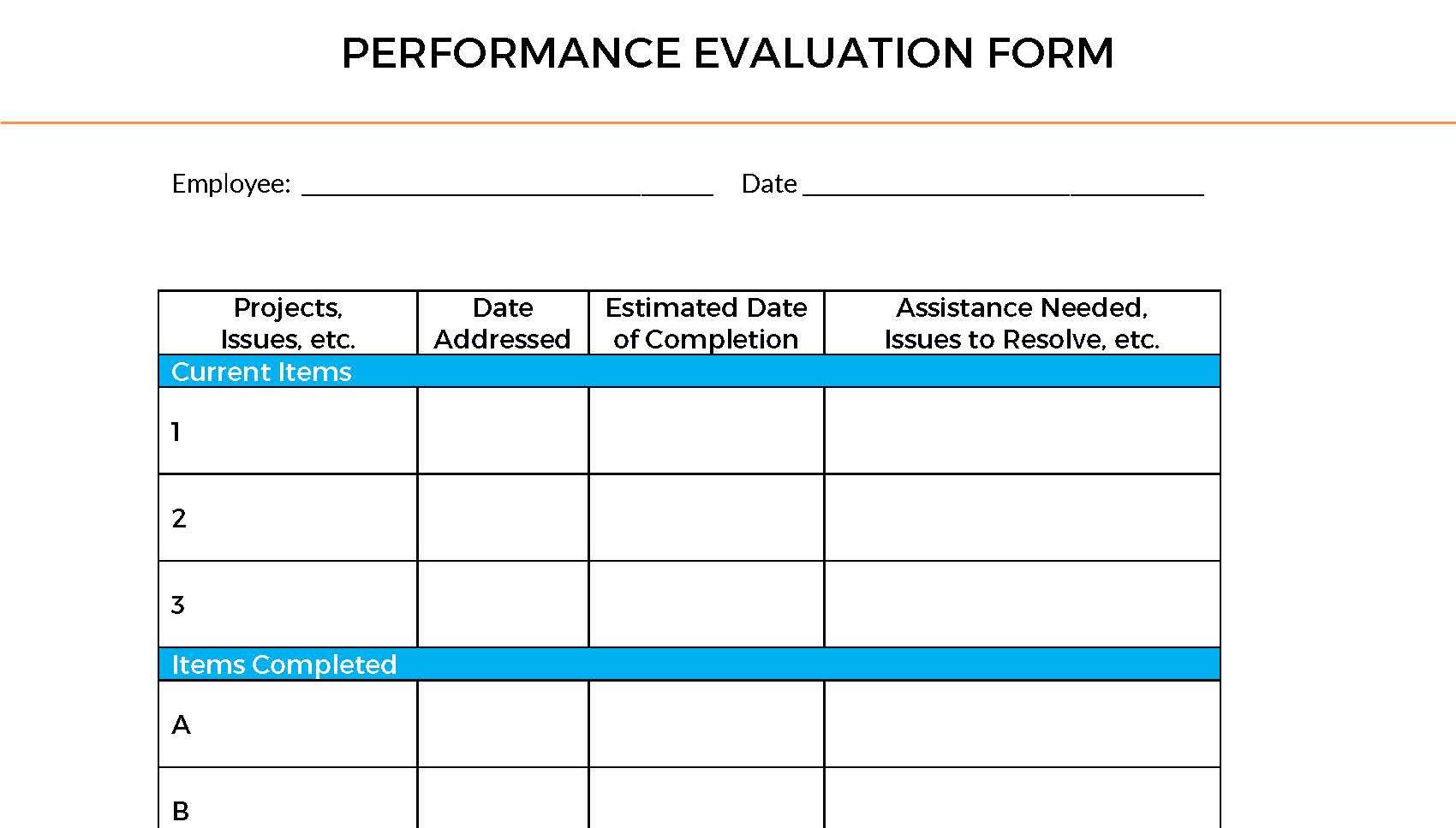

Performance Review for Your Nanny

Companies of all sizes establish periodic (written) reviews and evaluations of employees. It is a good employment practice for household employers to conduct performance reviews for nannies, because it allows the employer and employee to communicate what the employee...